Hello! This is Avarn — a worldwide IT recruitment agency. We have prepared a short overview of how the IT labor market in Eastern Europe has changed since March 2022. More precisely, we decided to analyze the vacancies we are working on and job offers that were made to our candidates by clients or competing companies.

Recent months have made their own adjustments to the labor market — some companies simply stopped hiring, others left the region. Many startups lost funding and stopped development. The number of vacancies in the market has decreased. But despite the crisis, experienced professionals are still in short supply. And what’s more, after the spring recession, the number of vacancies begins to grow.

We are going to compare the monthly averages for two periods — from March 2021 to March 2022 and from March 2022 to mid-June. Using that statistics, we want to see how the market has changed taking into account current world events.

All salary ranges are “net”, i.e. after-tax figures. All the numbers given are data obtained directly from the offers that were made to our candidates. Either by our customers or by our customers’ competitors. Due to our agreements with the clients, we do not disclose specifics about companies salary ranges.

Let’s start with a portfolio analysis. Our main specialization is the recruitment of experienced developers, QA engineers and Data Science specialists. Most of our vacancies are concentrated on these positions, and we have collected the most data on them. Of course, there are a lot of other positions being filled, various system and business analysts, project and product managers and specialists not connected with IT at all. We have combined all these positions in the diagram into “other”. We won’t talk about them. As well as about devops, which are also combined with system administrators and security specialists.

Let’s move on to JavaScript. I must say right away, we did not divide the developers by the frameworks/libraries used. According to our data, all offers are distributed more or less evenly, and there is no significant difference between developers using certain technologies.

Until March of this year, we had 47 vacancies on average in the work every month, after the crisis — 35. Here and further, according to the candidates’ stories, they choose from about 3 offers. Previously, they selected from 4. The offers are now received by 8% of the submitted candidates. Until March, offers were received by 12% of candidates.

If we talk about money, an experienced JS developer will be paid $4200. The range is from $3460 to $4775, these are the 25th and 75th percentile, respectively. In general, it is worth noting that despite the reduction in the market, in almost all cases, candidates have been paid more.

Our largest offer until March of this year was made by an American company engaged in the development of advertising technologies. The candidate was offered $8060.

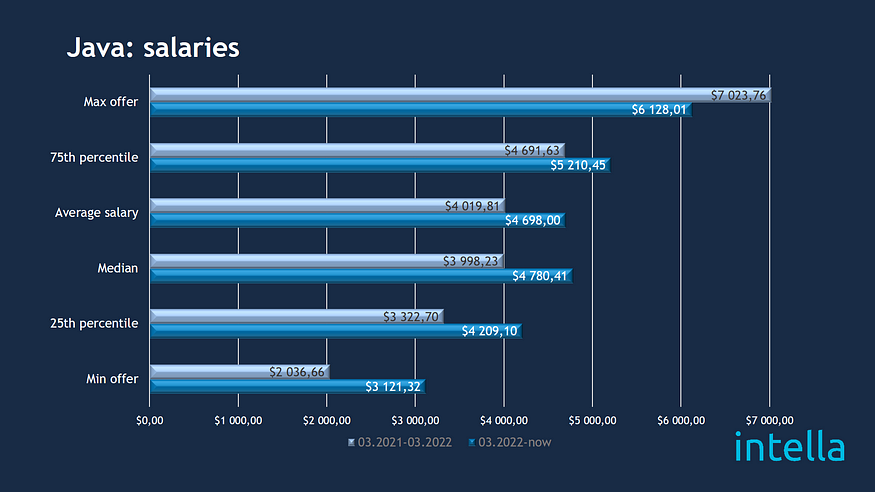

In the case of Java, the drop is felt a little stronger than the one with JS developers. The amount of vacancies in our portfolio has fallen from 47 to 26. Usually candidates choose between 2 employers. Offers are made about as often as to JS developers: before March in 12% of cases, after — in 8% of cases.

Until March, the average salary was $4020 with a range from $3320 to $4690. After March, the average salary was already $4698 with a range from $4209 to $5210.

The largest offer for one of our candidates came from a German IT outsourcing company. The candidate was offered relocation to Germany and a salary $7024.

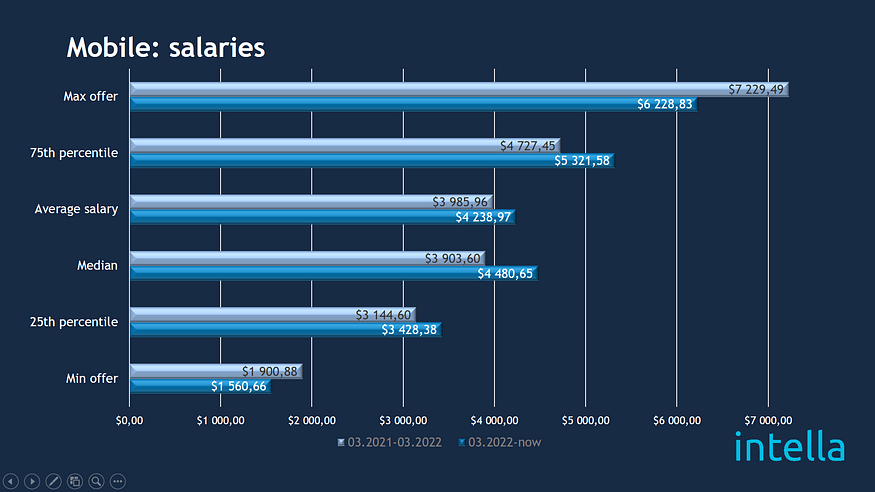

Talking about mobile development, we initially wanted to separate iOS and Android developers. But there was no sense in this, salaries were distributed evenly.

Until March, there were about 43 vacancies in the portfolio every month, after March the number became 21. Previously, candidates selected from almost 8–9 offers, now only from 2 to 3. Offers were previously received by 12% of candidates, now by 6%. Due to the withdrawal of companies from the market, many developers were left without work. Customers obviously know about it (everyone knows about it), and become more selective when choosing finalists.

Average salaries have not changed much. Until March, it was $3985, with a range from $3140 to $4720. After March, it is $4240, the range is $3430 — $5320. But at the same time, there are enough offers above the range — both from Android and iOS developers.

For example, after March, the largest offer we had was given to an Android developer — $6220.

And until March the Kazakh startup offered an iOS developer $7320.

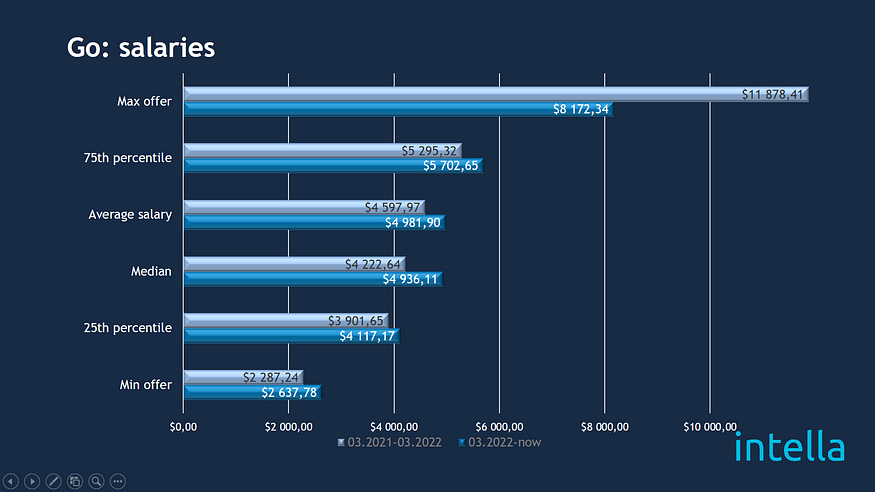

Go developers have fewer options to pick from, but the market is not empty. 2,5 offers per candidate after March, instead of almost 4 before. Offers are made with approximately the same frequency as ones for Java and JS developers. But there are less accepted offers.

Until March, on average, Go developers were offered $4600 (range from $3900 to $5300) After March, the numbers increased by 8% — to $4980 (range from $4120 to $5700).

The most generous offer to the Go developer from our clients was made by a crypto project from Serbia. The candidate was offered almost $12220.

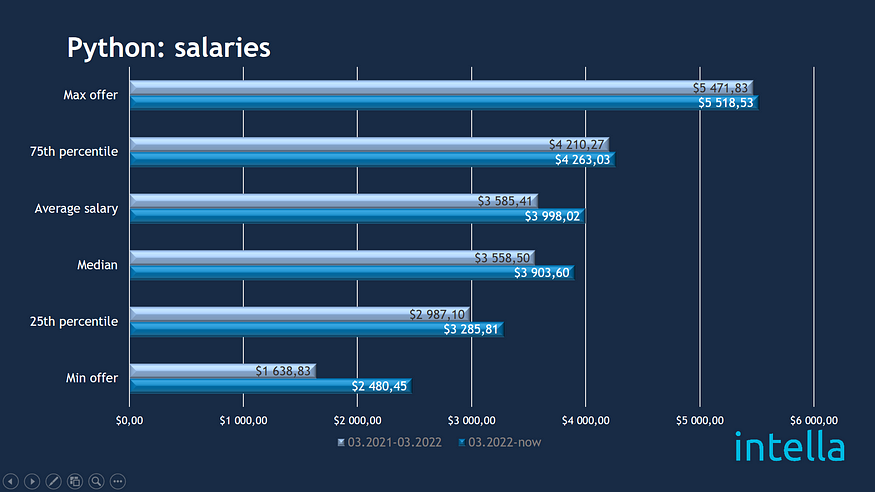

Until March, we were working on 26 Python vacancies per month. Now the number is about 15. In March, there were even fewer positions. Until March, candidates could pick from almost a dozen different vacancies at the same time. Now they choose from 2 to 3 companies.

Again, offers are made and accepted less often. This is partly because companies want to see more candidates before making an offer. Partly because candidates are cautious and try to explore more options before moving anywhere.

Until March, developers were offered from $2990 to $4210, an average of $3590. After March, the range was from $3290 to $4260, with an average salary of $4000.

The largest offer until March was made by one of the European banks — $5470. After March, a similar offer was received from an agrotechnical startup from Belarus.

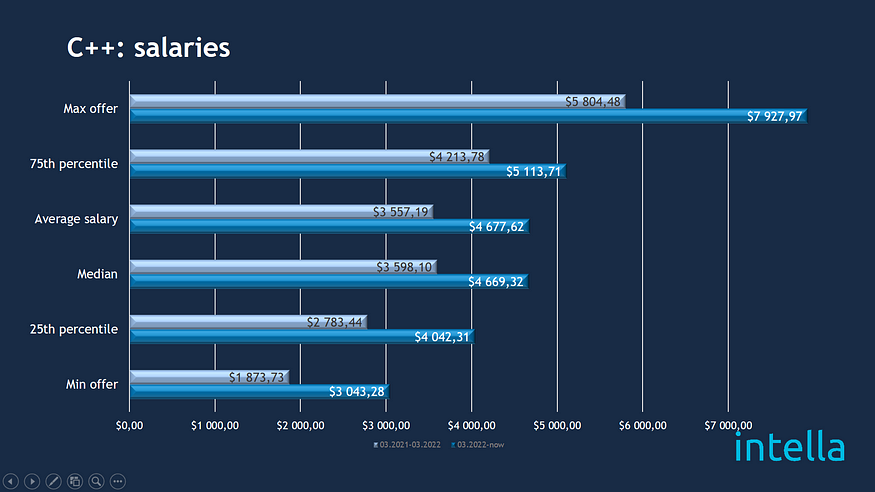

In the world of C++, everything is more or less stable. The number of vacancies in the portfolio has lowered, but not dramatically, and is recovering. Job offers are made and accepted as often as before March. But there is less choice for the candidate now.

Until March, the salary of C++ developers ranged from $2780 to $4210, the average salary was $3560. After March, the average salary is $4680, the range — $4040 to $5110. The growth is significant, but the reason for this is the increased requirements for candidates. There are only super-senior vacancies in the work now.

For example, after march we were looking for a Senior C++ developer for a European trading company. The client required 5 years of experience in development, English from B2, and Unix not to even mention STL and basic algorithms. Our candidate was a little short on experience, but he has worked on similar products and fit all other requirements. As a result, a company offered him $7920.

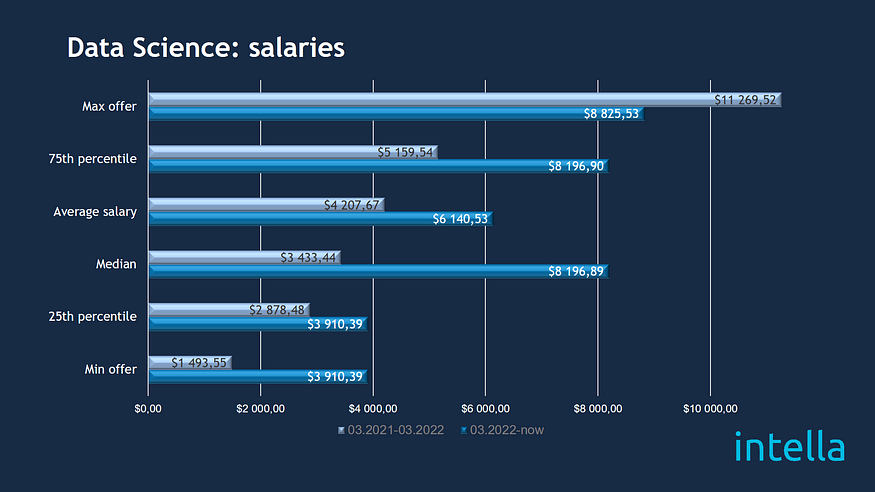

Data Science is a very generalized category for us, a collection of hodgepodge, which includes the data scientists themselves, data engineers and data analysts. The search is usually long and complicated because there are a few relevant specialists. But there are enough offers on the market, until March — about 7 per candidate, after — 4–5.

Salaries have changed a lot. This is mainly because in recent months companies have hired only Data Scientists, while the positions of analysts and engineers have almost completely dropped out of work.

The largest closure until March of this year was for a Division lead position. The candidate was offered $11270.

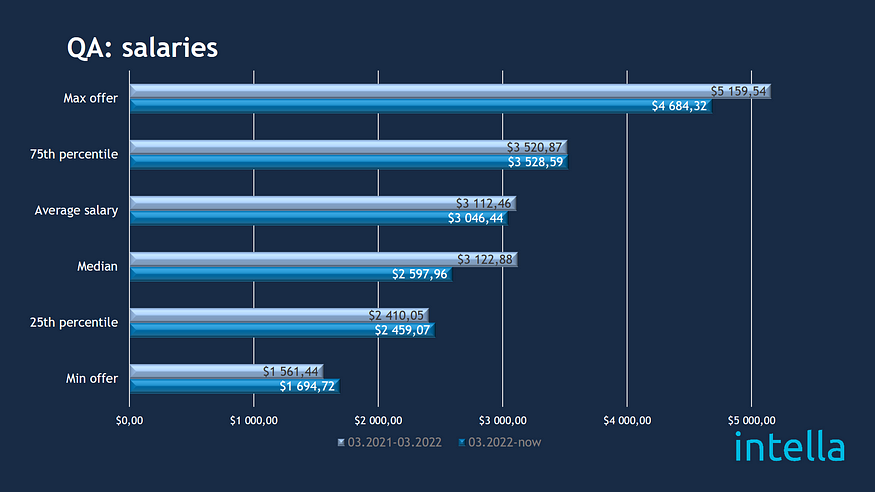

And the last (but not least) stream is QA. Like many companies, we did not distinguish between those who are called testers and QA engineers.

There are many vacancies, candidates have a choice. Until March, one specialist chose from 8 options, now from 6. Companies have become less likely to make offers. According to our clients’ feedback, they are reviewing the requirements.

The average salary until March was $3110; range — from $2410; to $3520.

At the same time, if you look separately at what was offered to manuals and automators, these are $2400 and $3670, respectively. Range for manuals — $2040 — $2810, for automators $3190 — $4140.

After March, the numbers did not change much, the average salary and ranges, in fact, remained at the same level.

The largest offer to our candidate was made by the German it-outsource. The senior automator was relocated to Germany with a salary of $5100.

In conclusion, we would like to summarize that the market has sunk after the February events, very noticeably. Nevertheless, it is quite alive. The average number of vacancies fell by more than 27%. Employers are in no hurry to hire future employees, and each candidate receives 50% fewer offers. But experienced specialists still continue to choose an employer without grabbing the first opportunities that catch their eye. And apparently, when it comes to the offer, candidates are trading well, because the average salary has increased by 19%.

All positions

Javascript

Java

Mobile

Go

Python

C++

Data Science

QA

Conclusion

Dynamics of the labor market in IT: salaries and vacancies

01.07.2022